In the wake of the changing global economy post the COVID-19 pandemic, contactless payment apps emerged as a vital tool for conducting transactions safely and efficiently. With the need to minimize physical contact and adhere to social distancing guidelines, these apps provided individuals and businesses in India with a secure and convenient alternative to traditional payment methods. This blog post explores how the contactless payment app became instrumental during the pandemic, its advantages, adoption in India, success stories, challenges, and the future of these apps in the country.

Contactless Payment Apps in India:

Overview of popular contactless payment apps in India

Contactless payment apps gained significant popularity in India during the pandemic. Several apps emerged as leaders in the market, offering diverse features and benefits to users. You can get these apps in Google Play Store. Some of the prominent contactless payment apps in India include:

Paytm, PhonePe, Google Pay, Amazon Pay, BHIM (Bharat Interface for Money), MobiKwik

Features and benefits of contactless payment apps

Contactless payment apps revolutionized the way transactions were conducted, providing numerous advantages to both customers and businesses. The key features and benefits of these apps are:

Quick and seamless transactions: Contactless payment apps enable swift and hassle-free transactions, allowing users to make payments within seconds.

Enhanced security: These apps employ robust security measures, including encryption and two-factor authentication, ensuring the safety of users' financial information.

Wide acceptance: Contactless payment apps are widely accepted across various merchants, ranging from large retail chains to small businesses, making them convenient for users.

Offers and rewards: Many apps provide attractive offers, discounts, and cashback rewards to incentivize users, promoting their continued usage.

Split payments: Some contactless payment apps allow users to split bills or payments among multiple individuals, making it convenient for group transactions.

Transaction history and tracking: Users can easily track and manage their transaction history within the app, providing transparency and control over their finances.

Utility bill payments: Many contactless payment apps offer the functionality to pay utility bills, such as electricity, water, and gas, eliminating the need for physical visits to payment centres.

Peer-to-peer transfers: Users can transfer money to friends, family, or acquaintances seamlessly through peer-to-peer transfer features available in these apps.

Advantages of Contactless Payment Apps during the Pandemic

During the pandemic, contactless payment apps offered several advantages that contributed to their widespread adoption in India.

Minimizing physical contact and reducing the spread of COVID-19

Contactless payment apps played a crucial role in minimizing physical contact between individuals, reducing the risk of spreading COVID-19. By eliminating the need for the physical exchange of cash or handling of cards, these apps provided a safer alternative for transactions. Customers could simply scan a QR code or use NFC (Near Field Communication) technology to make payments, ensuring minimal contact with surfaces or other individuals.

Convenience and ease of use for customers and businesses

Contactless payment apps introduced a new level of convenience for both customers and businesses. Customers no longer needed to carry physical wallets or search for loose change. With just a few taps on their smartphones, they could complete transactions effortlessly. Similarly, businesses benefited from streamlined payment processes, reducing the time spent on handling cash and facilitating quicker service for customers.

Encouraging cashless transactions and promoting the digital economy

The pandemic created a shift towards a cashless economy, and contactless payment apps played a vital role in driving this transformation. By promoting digital transactions, these apps reduced reliance on physical currency, leading to a more efficient and transparent financial ecosystem. Additionally, the digital nature of these transactions enabled better tracking and monitoring of financial activities, helping to combat tax evasion and promote transparency.

Ensuring secure and encrypted transactions

Security was a significant concern for users during the pandemic. Contactless payment apps addressed this concern by implementing robust security measures. Transactions made through these apps were encrypted, ensuring the confidentiality of sensitive information. Furthermore, many apps employed additional security layers, such as biometric authentication or PIN verification, providing users with peace of mind while conducting transactions.

Adoption and Growth of Contactless Payment Apps in India-h2

The adoption of contactless payment apps witnessed a significant surge in India during the pandemic. Several factors contributed to this growth.

Increase in the usage of contactless payment apps

With the necessity of contactless transactions, the usage of contactless payment apps soared across the country. People from various age groups and socio-economic backgrounds embraced these apps as a safer and more convenient payment option. The ease of use and availability of smartphones further facilitated the adoption of these apps.

Government initiatives to promote digital payments

The Government of India played an active role in promoting digital payments and reducing reliance on cash. Initiatives like "Digital India" and "Make in India" campaigns aimed to create awareness about the benefits of contactless payment apps and encourage their usage. The government also introduced incentives for merchants and consumers to adopt digital payment methods, further boosting their adoption.

Partnerships and collaborations with businesses and merchants

Contactless payment app providers forged partnerships with businesses and merchants to expand their reach and acceptance. This collaboration allowed users to make payments at various retail outlets, e-commerce platforms, restaurants, and even street vendors. By increasing the acceptance points, these apps became more accessible to users across different sectors, strengthening their position in the market.

Real-life Examples of Contactless Payment App Success Stories in India

The impact of contactless payment apps in India during the pandemic can be seen through various success stories:

Case study 1: Transformation of street vendors with contactless payments

One notable example is the transformation of street vendors and small businesses through the adoption of contactless payment apps. Traditionally, these businesses relied heavily on cash transactions, making it difficult to maintain hygiene and track sales. However, with the introduction of contactless payment apps, street vendors were able to offer customers a safer and more convenient payment option.

For instance, imagine a street food vendor in Mumbai who started accepting payments through a popular contactless payment app. Customers could now pay for their favourite snacks using their smartphones, eliminating the need for physical currency exchange. This not only reduced the risk of spreading infections but also expanded the vendor's customer base as people who preferred cashless transactions could now enjoy their offerings. As a result, the vendor experienced increased sales and improved financial management through the app's transaction tracking features.

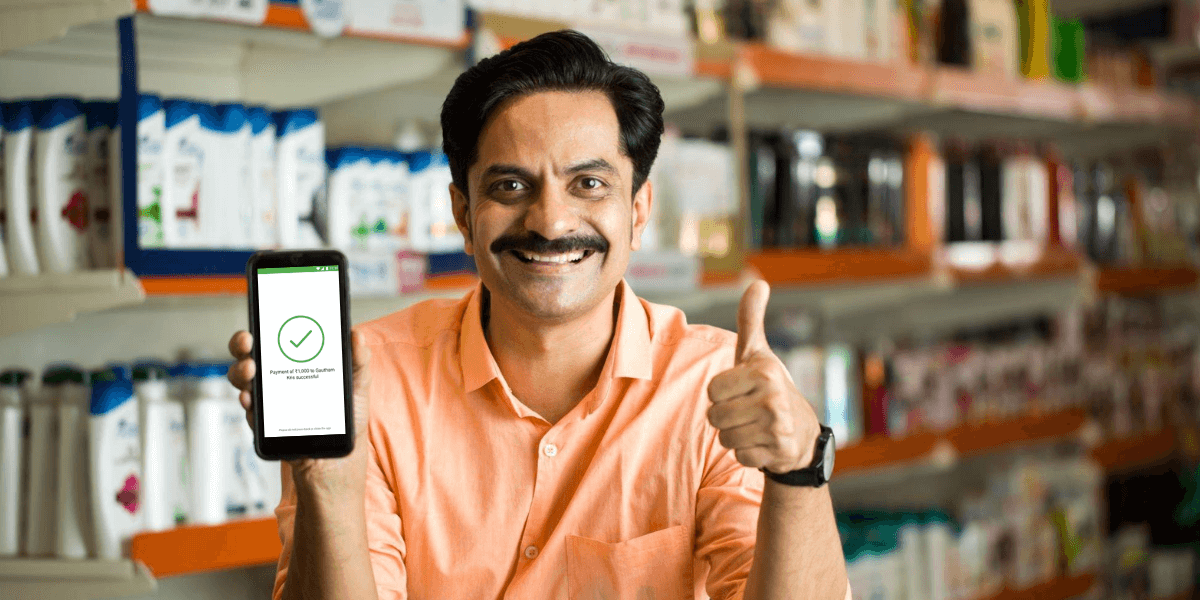

Case Study 2: Contactless payment adoption in small businesses

Contactless payment apps also played a vital role in enabling small businesses to adapt to the new normal. Many local stores, boutiques, and service providers embraced these apps to ensure a smooth and safe transaction experience for their customers.

Consider a small boutique in Bengaluru that integrated a popular contactless payment app into its operations. By displaying a QR code at the payment counter, customers could easily scan the code and complete their transactions using the app. This eliminated the need for handling cash or exchanging cards, creating a contactless and efficient payment process. The boutique witnessed an increase in customer satisfaction and loyalty as customers appreciated the convenience and safety of contactless payments. The ease of tracking transactions also helped the boutique streamline its accounting and inventory management processes.

Case study 3: Seamless payments for essential services

Contactless payment apps played a crucial role in facilitating seamless payments for essential services during the pandemic. From utility bill payments to healthcare services, these apps offered a convenient and secure way to settle bills without the need for physical interaction.

Imagine a scenario where a healthcare provider in Delhi adopted a contactless payment app to accept payments from patients. With the app's integration, patients could easily settle their medical bills digitally, avoiding any physical contact or handling of cash. This not only reduced the risk of spreading infections within the healthcare facility but also improved the overall billing process, leading to increased efficiency and patient satisfaction.

These real-life examples highlight the transformative impact of contactless payment apps in India during the pandemic. By enabling safe, convenient, and efficient transactions, these apps empowered individuals and businesses to navigate challenging circumstances and adapt to the new normal.

Challenges and Solutions for Contactless Payment Apps in India

While contactless payment apps have witnessed significant growth and adoption in India, they also face certain challenges. However, these challenges can be addressed through appropriate solutions.

Connectivity issues and technological barriers

In a country as vast as India, connectivity issues can pose a challenge to the seamless functioning of contactless payment apps. Limited internet access and network coverage in some areas may hinder the adoption and usage of these apps.

To overcome this challenge, app providers can work towards expanding network coverage and improving internet connectivity, especially in rural areas. Collaborations with telecom companies and the government can help ensure a more extensive reach and accessibility for contactless payment apps.

Additionally, optimizing the app's performance and reducing data usage can enhance the user experience, even in areas with limited connectivity.

Addressing security concerns and fraud prevention

Security and fraud prevention are critical considerations for contactless payment apps. Users may have concerns regarding the safety of their financial information and the risk of unauthorized access or fraudulent activities.

App providers can address these concerns by continuously strengthening the app's security measures. This includes implementing multi-factor authentication, encryption protocols, and robust fraud detection systems to safeguard user data and transactions. Regular security audits and updates should be conducted to stay ahead of potential threats. Additionally, user education and awareness campaigns can be conducted to educate users about best practices for secure app usage and how to identify and report suspicious activities.

Educating and creating awareness among the masses

While contactless payment apps have gained popularity, there is still a need for widespread education and awareness regarding their benefits and usage. Many individuals, especially in rural areas or older generations, may be unaware of these apps or hesitant to adopt them due to a lack of knowledge.

To address this challenge, app providers can collaborate with government agencies, educational institutions, and community organizations to conduct workshops, training sessions, and awareness campaigns. These initiatives should focus on explaining the features and advantages of contactless payment apps, providing step-by-step guidance on their usage, and addressing any concerns or misconceptions. By empowering individuals with knowledge, the adoption rate of these apps can be further increased.

Integration with existing payment infrastructure

In India, traditional payment systems and infrastructure still play a significant role, especially in rural areas or smaller businesses. Integrating contactless payment apps with existing payment infrastructure can be a challenge, as it requires collaboration and coordination among various stakeholders.

To overcome this challenge, app providers can work closely with financial institutions, payment gateways, and government bodies to establish interoperability and seamless integration. This can involve developing standardized protocols, APIs, and backend systems that allow contactless payment apps to seamlessly connect with existing payment systems. By providing a smooth transition from traditional methods to contactless payments, the adoption barrier can be minimized.

The Future of Contactless Payment Apps in India

The future of contactless payment apps in India looks promising, with several trends and developments shaping their growth and impact.

Continuous advancements and innovations

As technology continues to evolve, contactless payment apps will witness continuous advancements and innovations. These may include improved user interfaces, enhanced security features such as biometric authentication, integration with emerging technologies like blockchain, and the incorporation of artificial intelligence for personalized and frictionless user experiences.

Potential for further growth and adoption

The COVID-19 pandemic served as a catalyst for the adoption of contactless payment apps in India. However, the benefits and convenience offered by these apps go beyond the pandemic. As more people experience the advantages of contactless payments, the adoption rate is expected to continue growing, even in a post-pandemic era. With initiatives like digital literacy programs and financial inclusion efforts, the reach of these apps can extend to rural areas and underprivileged sections of society.

Impact on traditional banking and Financial systems

The rise of contactless payment apps is expected to have a significant impact on traditional banking and financial systems in India. With the increasing preference for digital transactions, banks may need to adapt their services and infrastructure to align with the changing needs and expectations of customers. This can include offering seamless integration with contactless payment apps, providing value-added services, and adopting innovative technologies to stay competitive in the evolving landscape.

Looking ahead, contactless payment apps are poised for continued growth and adoption. Advancements in user interfaces, security features, and integration with emerging technologies will enhance the user experience. Moreover, initiatives focused on digital literacy and financial inclusion will expand access to these apps in rural areas and underserved communities. As a result, traditional banking and financial systems may need to adapt to meet the evolving expectations of customers.

In conclusion, the pandemic has accelerated the adoption of contactless payment apps in India, highlighting their significance in promoting safe, efficient, and convenient transactions. By leveraging the benefits of these apps and addressing the associated challenges, India is poised to embrace a digital payment revolution. So, whether you're a street vendor, a small business owner, or a customer seeking convenience, now is the time to embrace the world of contactless payments.

Say Hi to Code Shastra

If you are seeking to build a new contactless app or any other app, look no further than Codeshastra. We offer a range of services including app development, DevOps, UI/UX design, and web development. With a roster of satisfied clients, we invite you to join them and become a client to experience the finest app solutions. Our team of skilled professionals is dedicated to delivering exceptional results tailored to your specific needs. Check out our services today!

Frequently Asked Questions

Yes, contactless payment apps prioritize the security of user transactions. They employ robust security measures such as encryption, multi-factor authentication, and fraud detection systems to ensure the safety of financial information.

Most contactless payment apps require an internet connection for real-time transactions and updates. However, some apps offer offline functionality, allowing users to make transactions in areas with limited or no connectivity. These offline transactions are securely stored and processed once an internet connection is established.

Yes, many contactless payment apps support international transactions. However, it's essential to check the app's terms and conditions and ensure that it is accepted in the country where the transaction is being made. Additionally, users should be aware of any applicable fees or foreign exchange rates associated with international transactions.

Contactless payment apps are primarily designed for smartphones as they rely on the device's NFC or QR code scanning capabilities. However, some apps also offer alternative options such as wearable devices or payment cards that can be linked to the app for contactless transactions.

Contactless payment apps can be used for various types of purchases, including retail transactions, online shopping, bill payments, transportation fares, and more. The acceptance of contactless payments may vary depending on the merchant or service provider. It's advisable to look for the contactless payment logo or inquire with the establishment before making a purchase.

While contactless payment app adoption is growing in rural areas, acceptance may still vary. Limited internet connectivity and technological infrastructure can pose challenges. However, efforts are being made to expand network coverage and promote digital literacy in rural communities, enabling wider acceptance of contactless payment apps.

About the Author

Luqmaan Shaik serves as the Blog Specialist at Codeshastra, where he leads a team of technical writers dedicated to researching and providing valuable content for blog readers. With a wealth of experience in SEO tools and technologies, his writing interests encompass a wide range of subjects, reflecting the diverse nature of the articles. During his leisure time, he indulges in an equal balance of web content and book consumption.