In recent years, the use of NFC payment apps has gained tremendous popularity in India. These apps provide a secure and convenient way for users to make digital transactions without the need for physical cash or cards. Choosing the right NFC payment app is crucial to ensure a seamless experience while prioritizing security.

This blog post will compare the top NFC payment apps available in India in 2023, helping users make informed decisions and enjoy the benefits of contactless transactions. You will get all these apps at Google Play Store or Apple Store.

Understanding NFC Technology

Near Field Communication (NFC) technology plays a pivotal role in enabling mobile payments. It allows for communication between devices nearby, typically within a few centimeters. NFC technology provides several advantages for contactless transactions, such as speed, ease of use, and compatibility with a wide range of devices. By simply tapping or bringing their smartphones close to an NFC-enabled terminal, users can complete transactions quickly and efficiently.

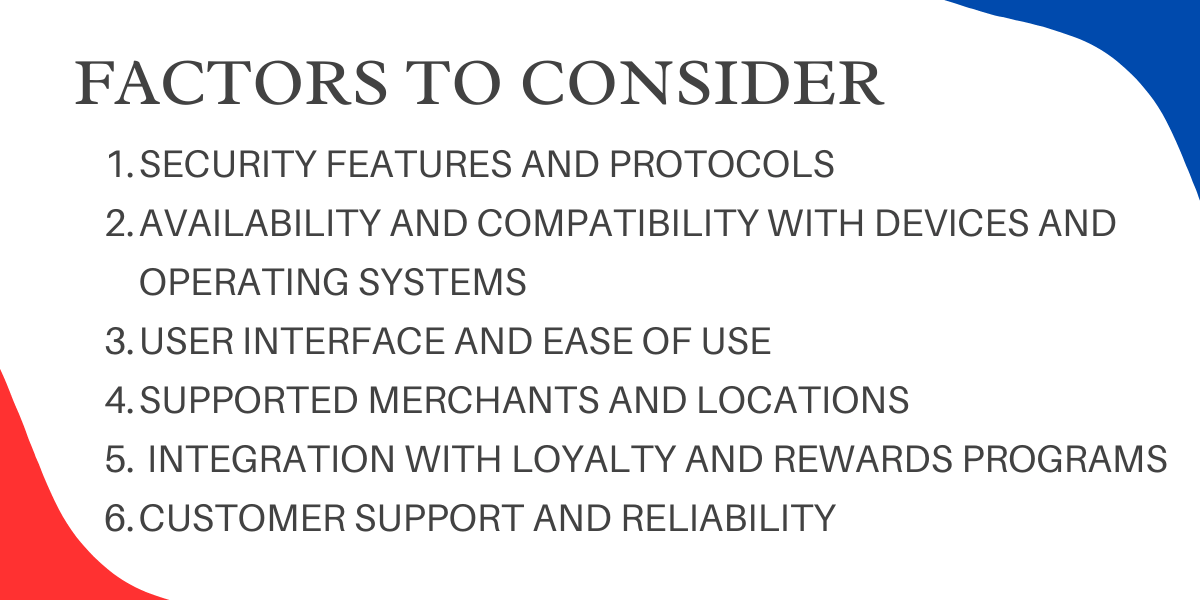

Factors to Consider When Choosing NFC Payment Apps

Security features and protocols:

When evaluating NFC payment apps, it is essential to prioritize security. Look for apps that offer robust security measures such as encryption protocols, biometric authentication, and tokenization. These features ensure that sensitive financial information remains protected during transactions.

Availability and compatibility with devices and operating systems:

Ensure that the NFC payment app you choose is available for your specific device and operating system. Compatibility plays a crucial role in providing a seamless experience and avoiding any compatibility issues that may arise.

User interface and ease of use:

An intuitive and user-friendly interface enhances the overall experience of using an NFC payment app. Look for apps that have a simple and streamlined user interface, making it easy to navigate and perform transactions effortlessly.

Supported merchants and locations:

Check if the NFC payment app supports a wide range of merchants and locations. The broader the acceptance network, the more convenient it will be for you to use the app at various stores, restaurants, and other establishments.

Integration with loyalty and rewards programs:

Some NFC payment apps offer integration with loyalty and rewards programs, allowing users to earn points or discounts for their transactions. Consider whether the app aligns with your preferred loyalty programs and offers additional benefits for your spending.

Customer support and reliability:

Opt for NFC payment apps that provide reliable customer support in case of any issues or concerns. It is crucial to have a reliable support system to address queries promptly and ensure a smooth user experience.

Top NFC Payment Apps in 2023

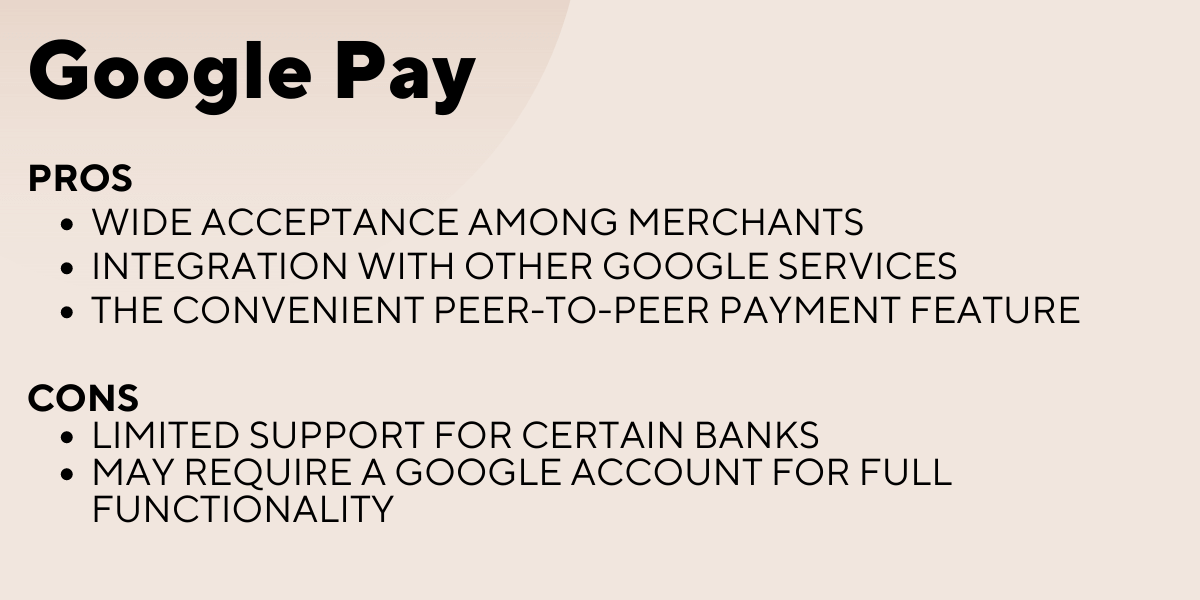

A. Google Pay:

Overview:

Google Pay is a popular NFC payment app that provides a range of features for seamless digital transactions. It allows users to make payments, split bills, and even send money to friends and family. Google Pay has gained widespread acceptance and is known for its simplicity and ease of use.

User experience and interface analysis:

The app offers a clean and intuitive user interface, making it easy for users to navigate and perform transactions. It provides a smooth and seamless experience with its quick response time and efficient transaction processing.

Pros and cons of using the app:

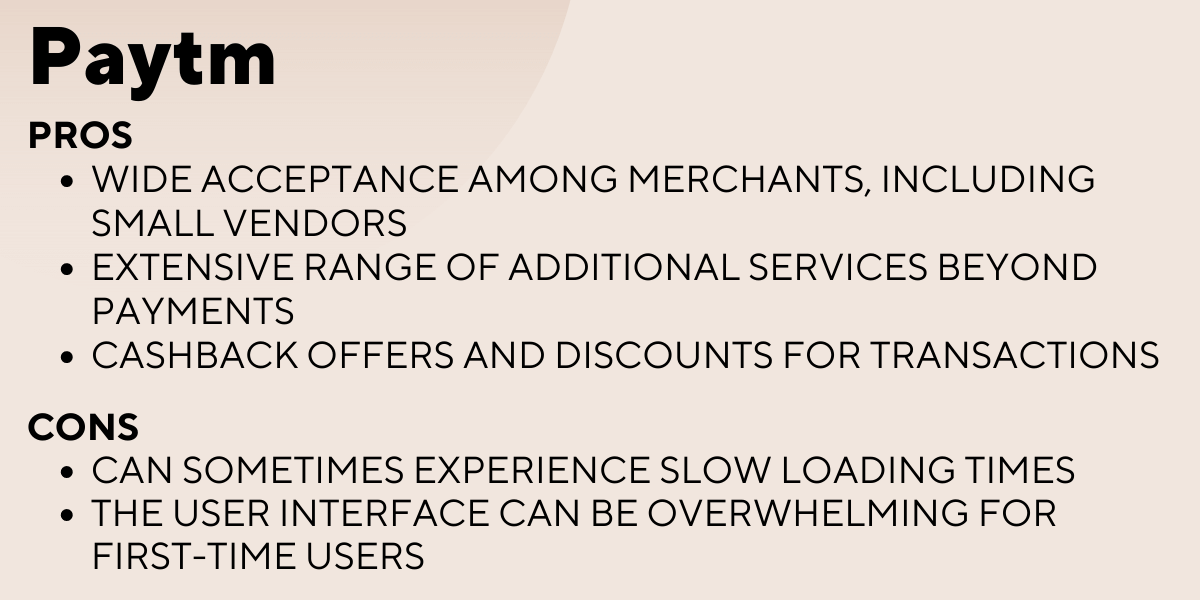

B. Paytm:

Overview:

Paytm is a leading NFC payment app in India, offering a range of services beyond payments. It allows users to pay bills, recharge mobile phones, book tickets, and more. Paytm has a strong user base and extensive merchant acceptance across the country.

User experience and interface analysis:

Paytm provides a user-friendly interface with a clear layout and easy-to-understand options. The app offers a seamless user experience with quick transaction processing and a variety of services available within the app.

Pros and cons of using the app:

Pros:

- Wide acceptance among merchants, including small vendors

- Extensive range of additional services beyond payments

- Cashback offers and discounts for transactions

Cons:

- Can sometimes experience slow loading times

- The user interface can be overwhelming for first-time users

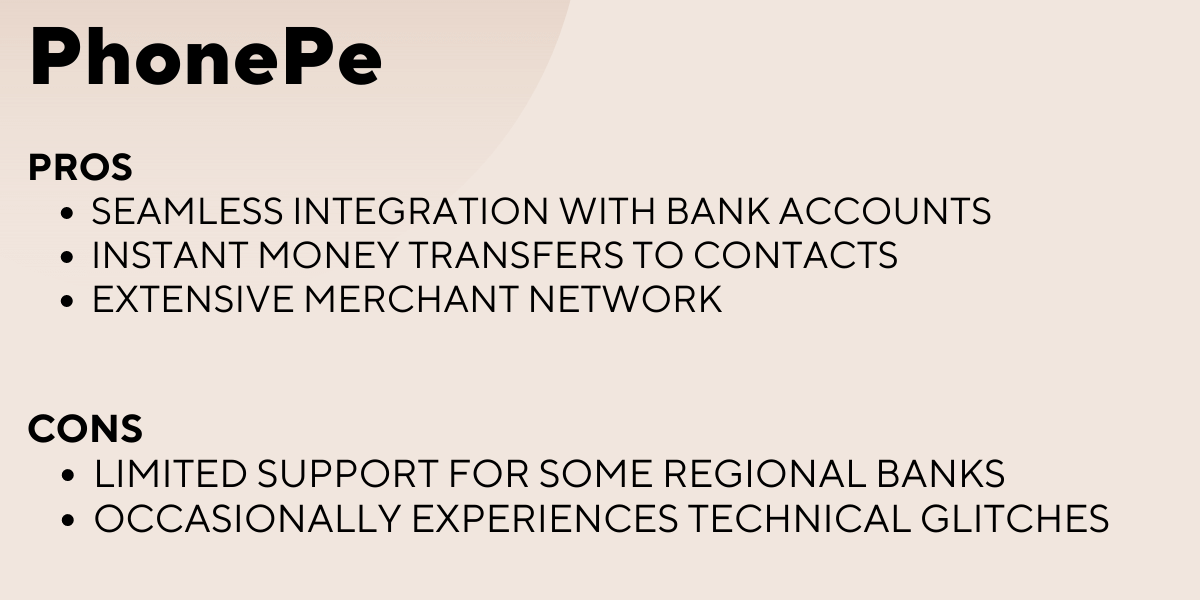

C. PhonePe:

Overview:

PhonePe is another popular NFC payment app in India known for its reliability and ease of use. It offers a variety of features, including payments, bill splitting, mobile recharges, and more. PhonePe has gained a significant user base and is accepted by numerous merchants across the country.

User experience and interface analysis:

PhonePe provides a clean and intuitive interface, ensuring a smooth user experience. The app is known for its quick transaction processing and minimalistic design, making it easy to navigate and perform transactions effortlessly.

Pros and cons of using the app:

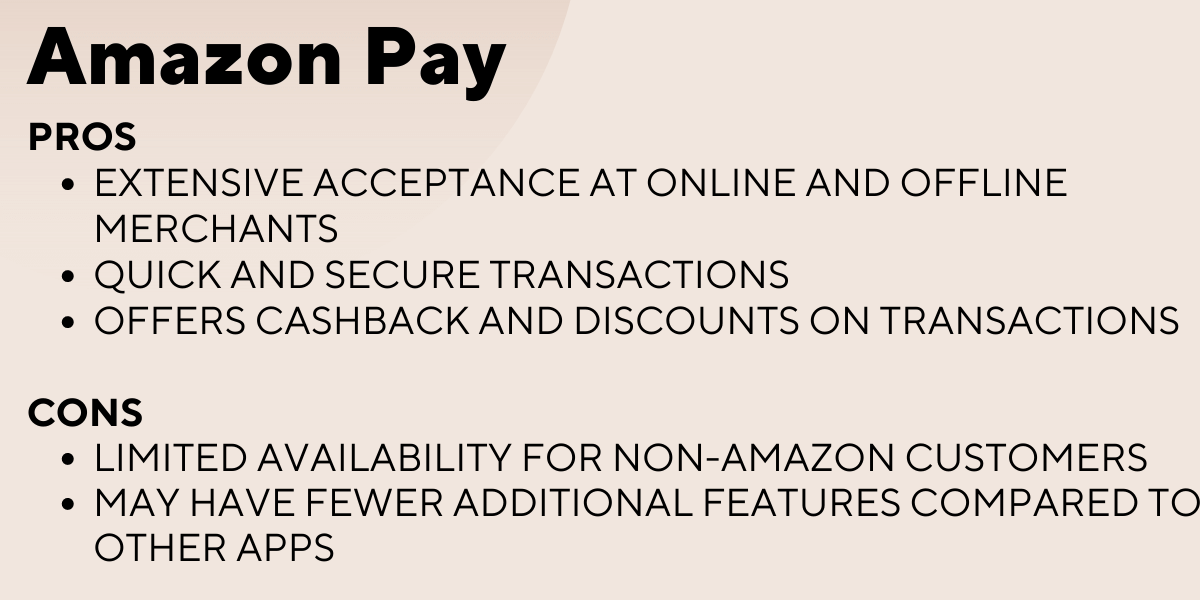

D. Amazon Pay:

Overview:

Amazon Pay, offered by the e-commerce giant Amazon, is a widely used NFC payment app in India. It allows users to make payments on Amazon as well as at various offline merchants. Amazon Pay offers a range of additional services and is known for its reliability.

User experience and interface analysis:

Amazon Pay features a user-friendly interface with a familiar design for Amazon customers. The app ensures a smooth and hassle-free user experience, with seamless integration with Amazon's ecosystem.

Pros and cons of using the app:

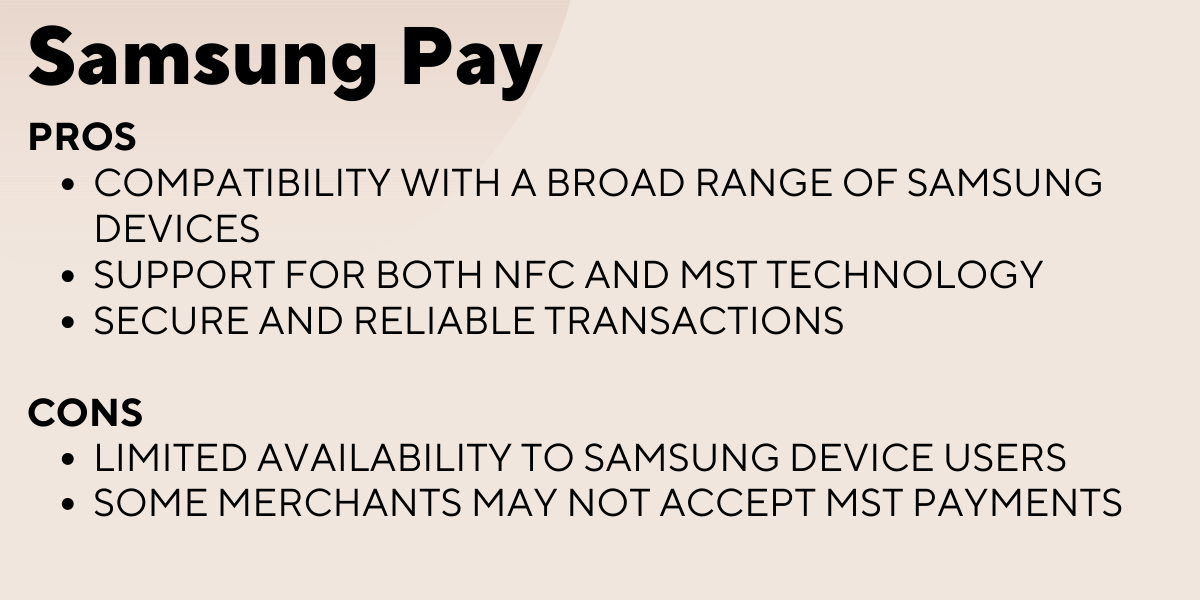

E. Samsung Pay:

Overview:

Samsung Pay is a popular NFC payment app available to Samsung smartphone users. It offers a secure and convenient way to make payments using compatible Samsung devices. Samsung Pay supports both NFC and MST (Magnetic Secure Transmission) technology, allowing users to make payments even at non-NFC-enabled terminals.

User experience and interface analysis:

Samsung Pay provides a user-friendly interface with intuitive navigation. The app is designed to offer a seamless and efficient user experience, with quick transaction processing and compatibility with a wide range of Samsung devices.

Pros and cons of using the app:

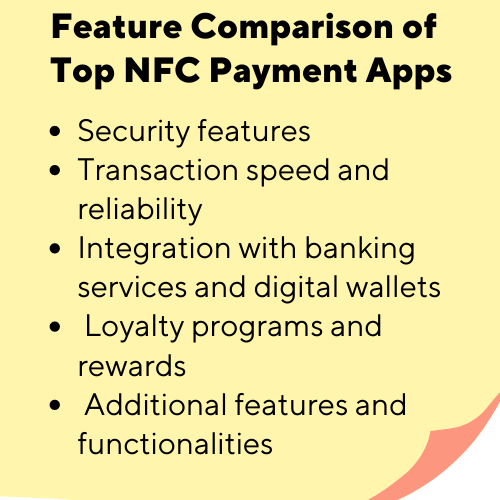

Feature Comparison of Top NFC Payment Apps

When comparing the top NFC payment apps, it is essential to consider various features and functionalities:

A. Security features :

Look for apps that offer robust security measures, such as encryption protocols, biometric authentication (fingerprint or face recognition), and tokenization. These features ensure that your financial information remains protected during transactions.

B. Transaction speed and reliability:

Consider the speed and reliability of transactions offered by each app. Look for apps that provide quick and seamless transaction processing, minimizing any delays or issues during the payment process.

C. Integration with banking services and digital wallets:

Check if the NFC payment apps integrate smoothly with your preferred banking services and digital wallets. Seamless integration allows you to easily link your bank accounts, transfer funds, and manage your finances within the app.

D. Loyalty programs and rewards :

Some NFC payment apps offer integration with loyalty programs and provide rewards or cashback offers for transactions. Consider whether the app aligns with your preferred loyalty programs and offers additional benefits for your spending.

E. Additional features and functionalities :

Evaluate the additional features and functionalities offered by each NFC payment app. These may include options like bill splitting, mobile recharges, ticket bookings, or in-app shopping. Choose an app that provides features that align with your needs and preferences.

How to Use NFC Payment Apps :

To help you get started with NFC payment apps, here is a step-by-step guide:

A. Setting up and using NFC payment apps :

- Download the app from the respective app store and install it on your device.

- Follow the on-screen instructions to set up your account, including linking your bank account and adding payment methods.

- Ensure that NFC is enabled on your device through the settings menu.

- Open the NFC payment app and authenticate yourself using the provided security measures.

- To make a payment, bring your device close to the NFC-enabled terminal and wait for the confirmation.

B. Adding payment methods and linking bank accounts :

- Within the app, navigate to the settings or account section.

- Look for options to add payment methods such as credit or debit cards, digital wallets, or bank accounts.

- Follow the prompts to enter the necessary information and verify the added payment methods.

- To link your bank account, select the appropriate option and follow the provided instructions to link your account securely.

C. Making transactions at various merchants and locations :

- Ensure that the merchant supports NFC payments by looking for the NFC logo or asking the staff.

- At the point of sale, open the NFC payment app on your device and authenticate yourself if required.

- Hold or tap your device near the NFC-enabled terminal, usually located at the card reader.

- Wait for the confirmation on both your device and the terminal, indicating a successful transaction.

D. Troubleshooting common issues and errors :

- If you encounter any issues during transactions, ensure that NFC is enabled on your device and that the app is up to date.

- Check if the merchant's terminal is NFC-enabled and functioning correctly.

- Ensure that you have a stable internet connection, as some NFC payment apps require an internet connection for transaction processing.

- If problems persist, reach out to the app's customer support for assistance.

In conclusion, choosing the right NFC payment app is crucial for secure and convenient digital transactions in India. Google Pay, Paytm, PhonePe, Amazon Pay, and Samsung Pay are among the top NFC payment apps in 2023. Consider factors such as security features, transaction speed, integration with banking services, loyalty programs, and additional functionalities when selecting an app.

Follow the provided steps to set up and use NFC payment apps, and troubleshoot common issues if necessary. By exploring and trying different NFC payment apps, you can personalize your digital payment experience while enjoying the benefits of contactless transactions. Embrace the convenience and security of NFC payment apps to simplify your financial transactions in today's digital world.

Introducing Codeshastra :

Your Destination for Contactless App and Beyond

When it comes to building a new contactless app or any other app, Codeshastra is the ultimate solution you've been searching for. Our comprehensive range of services includes app development, DevOps, UI/UX design, and web development.

We take pride in our track record of satisfied clients and now invite you to join us by becoming a valued client yourself and discovering firsthand the exceptional app solutions we provide. With a team of highly skilled professionals, we are committed to delivering outstanding results that are tailored to your specific requirements. Don't wait any longer - explore our services today and experience the excellence of Codeshastra!

Frequently Asked Questions

About the Author

Luqmaan Shaik serves as the Blog Specialist at Codeshastra, where he leads a team of technical writers dedicated to researching and providing valuable content for blog readers. With a wealth of experience in SEO tools and technologies, his writing interests encompass a wide range of subjects, reflecting the diverse nature of the articles. During his leisure time, he indulges in an equal balance of web content and book consumption.